Checking Profile

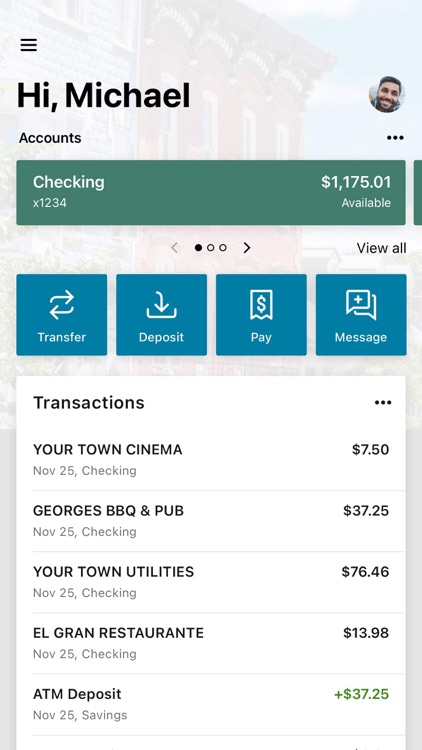

Checking profile offer quick, smoother entry to your own financing. You need build deposits as frequently as you want, and most banking companies offer an atm card to view the money, or even to charges debits on places. Definitely, it is possible to utilize the conventional types of composing monitors.

Specific checking membership spend interest. Speaking of entitled negotiable buy of withdrawal (NOW) account. The greater number of commonly used method of, a request deposit membership, cannot pay notice.

There are charge which can be on the examining levels, aside from the newest see print fees. These are different according to financial you decide on. Some have a tendency to fees a month-to-month fix commission regardless of your debts, anybody else tend to costs a fee every month should your balance falls below a certain point. Further, certain associations cost you based on the transactions you will be making, for example for each Atm detachment, otherwise for every single view your create.

Currency Market Put Accounts (MMDA)

An enthusiastic MMDA is simply a free account you to adds up appeal. You’ll be able to establish monitors from it. The rate of interest is normally greater than that of checking otherwise coupons account. Although not, they want increased minimum balance so you can https://elitecashadvance.com/personal-loans-mo/windsor/ secure you to focus. The better your balance gets, the greater your own interest may rise.

Although not, its less much easier in order to withdraw funds from an MMDA than just its away from a bank account. Youre restricted to half a dozen transmits on the membership 30 days, and simply around three of these are through composing a check. And, you will find always purchase fees of these types of accounts.

Coupons levels

You may make withdrawals of savings accounts, but there is less liberty than which have a bank account. Eg a keen MMDA, just how many withdrawals or transmits can be restricted.

There are some different types of savings accounts. Both common is actually passbook and report. Passbook account involve accurate documentation book one to music every deposits and you may withdrawals and may end up being demonstrated upon and make these purchases. That have a statement bank account, youre sent a statement demonstrating most of the distributions and you can places.

Borrowing from the bank Commitment Accounts

This type of account are similar to the ones from financial institutions, however with another type of label. Into the a credit connection, might keeps a portion draft membership (a bank account), a share membership (savings account), or a percentage certification membership (certificate off deposit account).

The wonderful thing about borrowing unions is that they always charges shorter to own banking services than simply banking institutions carry out. If you have the means to access one to, put it to use!

Licenses regarding Deposit (CD)

Cds try day places. They give an ensured interest to have a specified label in fact it is because the short because a short while otherwise due to the fact much time because the decade.

Once you select name you usually can’t withdraw your money through to the name ends. In many cases the bank enables you to withdraw the eye you’ve got earned for the Computer game. Due to the fact Dvds is actually to have a flat timeframe, the pace off go back is usually higher as well as the extended the expression, the greater brand new yearly percentage yield.

A penalty might be awarded if you withdraw your own money just before the brand new readiness of the identity. Often the fresh punishment can be very highest, dinner to your interest won and your dominating investment.

Their lender will notify you just before their Video game grows up, but commonly Dvds renew immediately. You should keep tabs on their maturity go out if you’d want to remove the fund up until the Video game moves more towards the another label.

This hinges on how you propose to make use of the account. If you’d like to grow your currency and do not you would like to access they readily, place it in the a Cd.

Leave a Reply